The EMBER report finds that an increasing use of solar and wind generation by ASEAN countries, has led to a shift towards clean power. This is especially true when 99% of the wind and solar potential in ASEAN, reportedly remains untapped.

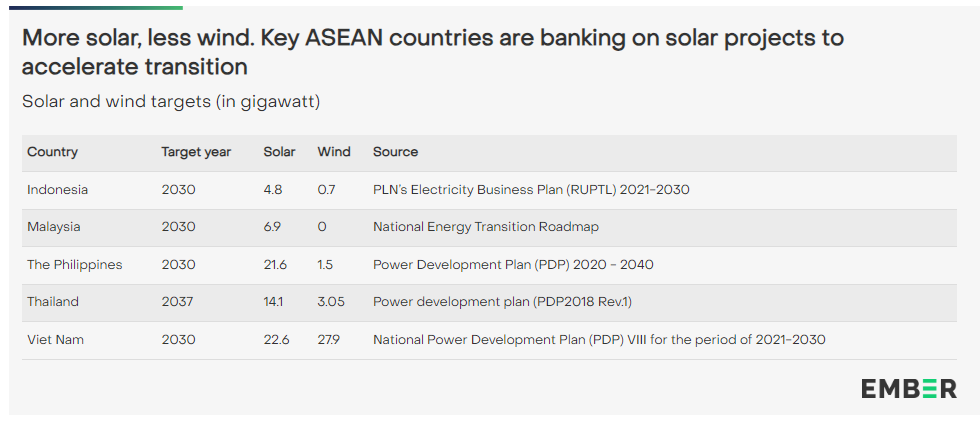

Using solar and wind would reportedly help to get on track with the IEA’s 2050 net zero scenario, 164 GW of solar and 65 GW of wind need to be installed by 2030. In its report titled, ‘Beyond Tripling: Keeping ASEANs Solar and Wind Momentum’ EMBER tracks solar and wind generation in ASEAN between 2015 and 2022. It analyses the additional capacity needed by 2030 to align with the International Energy Agency’s (2050 Net Zero Emission). It particularly focuses on the ASEAN countries’ power sector’s regulatory environment, which can lead to solar and wind power growth in those countries. The report focuses on Indonesia, Malaysia, the Philippines, Thailand, and Viet Nam, considering these countries as key players in the region’s total electricity generation, in order to formulate feasible recommendations.

The report finds that, the combined solar and wind generation in ASEAN grew from 4.2 TWh to 50 TWh between 2015 and 2022. It accounted for 14% (46 TWh) of the total electricity demand growth seen in the same period. Some new policy introduction, for instance in Viet Nam’s Feed-in Tariff policy in 2017 was the primary driver behind this growth. Viet Nam alone contributed 69% of the total solar and wind generation in the region in 2022.

Among other countries, ASEAN’s solar and wind generation reportedly rose 15% (+6.4 TWh) from 2021 to 2022. In comparison, last year’s growth was reported to be more significant at 67% (+18 TWh), driven by the rush of solar feed-in tariff project completion in Viet Nam.

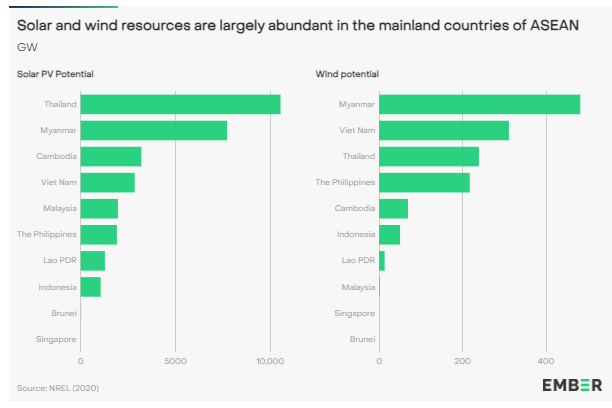

It finds that, the ASEAN region has 27 GW of solar and 6.8 GW of wind installed capacity in 2022. It represents less than 1% of the approximately 30,523 GW of solar and 1,383 GW of wind theoretical potential, as estimated by the National Renewable Energy Laboratory (NREL). The report identifies, Thailand, Myanmar, and Cambodia as the top three countries with the largest solar potentials, while Myanmar, Viet Nam, and Thailand rank as the top three for prospective wind capacity among ASEAN countries.

In order to attract investment, ASEAN countries need streamlined renewable supply chains, investments in grid extensions and modernization. It requires to be combined with energy storage facilities which will be an essential prerequisite to integrating solar and wind technologies into the power grid. Going forward, the report finds that, the region is expected to boost the growth of clean power through policy support. For instance with auction mechanisms in Viet Nam and green electricity tariffs in Malaysia, as well as rooftop solar PV system incentives and the development of battery energy storage systems in Thailand.

The report finds that wind and solar capacity use can unlock clean transportation and lead to new opportunities. It can also lead to new opportunities to bolster ASEAN’s preparedness for the electrification of the transportation sector. It may lead to new solar and wind opportunities that may further equip ASEAN for the development of such charging infrastructure.

In addition to being a cleaner option, solar and wind are reportedly getting cheaper worldwide. Therefore, it recommends capturing these falling prices in the region and revamping the power market. It could create incentives to leverage the deployment scale and create more efficient supply chains for both energy sources, thus improving the investment climate. Furthermore, policymakers in ASEAN are encouraged to invest in grid modernization and flexibility measures. It would ensure the secure and cost-effective integration of solar and wind technologies into the power grid.