Clime Capital, based in Singapore, is moving ahead with further investments following its successful backing of a dozen clean tech firms in Southeast Asia. With a focus on blended finance, the fund plans to make 27 additional investments in the coming years.

Clime Capital has announced a substantial increase in its funding, supported by institutional investors and the World Bank, totaling at least US$127 million, up from just over US$20 million in its initial iteration four years ago. As per the firm, each investee now stands to receive loans of up to US$10 million, a tenfold increase from previous levels.

Mason Wallick, CEO of Clime Capital, sees significant growth opportunities in all three core markets of SEACEF II – Indonesia, Vietnam, and the Philippines. Reflecting on the success of SEACEF I, where investees raised 27 times the initial capital, Wallick emphasizes the potential for expansion in these markets.

However, regulatory hurdles remain a challenge, leading towards a phased approach to investment disbursement contingent on policy improvements. Despite these challenges, Clime Capital’s SEACEF stands out as a key player in scaling up clean energy in Southeast Asia, aiming to reduce reliance on fossil fuels through blended finance initiatives.

Wallick explains that SEACEF employs a “risk-gating” strategy, where a portion of the investment is initially allocated, with the remainder contingent on regulatory advancements. This approach aims to mitigate regulatory risks while enabling portfolio firms to scale effectively.

It is reported that investing in large-scale renewables proves challenging in Indonesia and Vietnam due to issues such as unfair competition and outdated policies. However, opportunities abound, particularly in emerging sectors like renewable hydrogen and electric mobility.

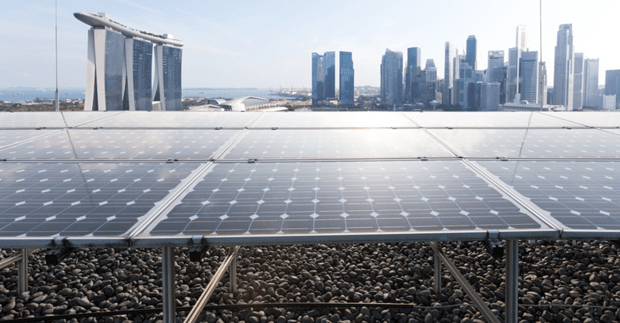

SEACEF’s portfolio includes ventures in electric mobility and rooftop solar projects, leveraging simpler regulations in Vietnam and Indonesia. Despite past challenges, Clime Capital remains optimistic about the region’s renewable energy prospects, particularly in hydrogen and pumped hydropower energy storage systems.

With its support toward regulatory improvements, Clime Capital sees ample room for growth and investment opportunities in Southeast Asia’s evolving clean energy landscape.