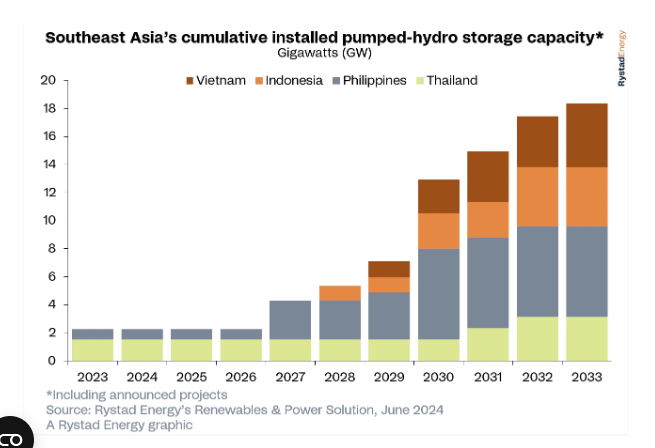

Pumped-storage hydropower, or simply pumped hydro, is set to play an increasing role in Southeast Asia’s energy transition. This mature technology for large-scale energy storage can bolster grid reliability as fossil fuel generators are phased out in favor of renewable sources. Pumped hydro capacity in Southeast Asia is projected to surge from 2.3 gigawatts (GW) today to 18 GW by 2033, representing a nearly eightfold increase in less than a decade, and attracting an estimated total investment of between US$12 billion and US$70 billion.

With 64% of the region’s power generation coming from fossil fuels, reliable and green energy storage solutions are crucial to enhance electricity system flexibility, particularly as more renewable energy sources like solar and wind become integrated. Currently, 2.7 GW of pumped hydro storage is under construction, with the remaining 13.3 GW in various stages of development. This expansion will diversify the region’s renewable energy landscape, currently centered on the Philippines and Thailand. While Thailand boasts the most existing capacity for now, the Philippines will soon surpass it with about 5.7 GW of capacity in the pipeline.

Other countries in the region investing in pumped hydro include Vietnam and Indonesia, which boast about 4.5 GW and 4.2 GW of pending capacity, respectively. Thailand will also contribute to the region’s growth through 2033, with an additional 1.6 GW slated for development.

Policymaking has been a pivotal force in the short term, especially with policies favoring pumped hydro installations driving this momentum forward. For instance, the Philippines Department of Energy (DOE) is actively regulating energy storage technologies, including pumped hydro. In the country’s upcoming Green Energy Auction Program (GEAP 3), anticipated in the second half of 2024, the DOE plans to offer 3.1 GW of pumped hydro capacity. Similarly, Vietnam’s national Power Development Plan 8 (PDP 8) aims to attain 2.4 GW of pumped hydro by 2030, with projects like Bac Ai and Nihn Son already underway. Furthermore, Indonesia, Thailand and other regional nations are progressing with pumped hydro through policy frameworks.

State-owned utility companies dominate pumped hydro projects in most of Indonesia, the Philippines, Vietnam and Thailand. This trend is evident with the top three developers in Southeast Asia, all of which have significant government ownership. Indonesia’s state-owned utility company PLN is the leading developer in the region, with 3.7 GW pumped hydro projects in the pipeline. The high upfront costs and the long time it takes to see a return on investment make pumped hydro projects less attractive to private companies. Additionally, the licensing process can be unpredictable, dragging out project timelines and adding risk for potential developers.

The Philippines, however, bucks this trend. Unlike its neighbors, the nation has an unbundled electricity market, meaning there’s competition in both power generation and distribution. This competition creates volatile wholesale electricity prices, which can fluctuate more than in regulated markets. This presents an economic incentive for pumped hydro storage, making it a more attractive option for developers in the Philippines.

Pumped-storage hydropower is a method of storing hydroelectric energy, used by electric power systems for load balancing. It works by pumping water from a lower-elevation reservoir to a higher one, storing energy that can later be used during periods of high electrical demand. Low-cost surplus off-peak electric power typically powers the pumps, and the stored water is released through turbines to generate power when needed.

Pumped hydro projects rely heavily on specific geographical conditions, presenting obstacles in site selection and land acquisition. Many potential sites are situated in rural areas lacking necessary infrastructure like transmission lines and road access for construction. These deficiencies can lead to increased costs and project development timelines, straining project finances. Moreover, obtaining land for these projects is complicated, given they are often placed in protected areas, such as forests, river systems, or urban zones, necessitating strict adherence to environmental regulations to avoid delays.

Despite these challenges, pumped hydro projects offer significant socio-economic advantages to regions where they are deployed. Aside from ensuring a stable electricity supply, they can spur infrastructure growth, improving accessibility in the area. Additionally, these projects generate job opportunities, particularly benefiting residents during construction and operation, thereby boosting the region’s economy. Maximizing these benefits requires effective risk management strategies, encompassing strategic planning, thorough preparation, precise execution, and continuous evaluation by both developers and policymakers.