A study entitled ‘Global Market Outlook For Solar Power 2023-2027’ (With a Focus on South East Asia) has been released. The major findings of the insightful report are as follows-

With improvement in solar investments SEA market is expected to grow 13% to 3.8 GW this year. However, report says as most SEA nations are still gearing up their solar programmes,so there are uncertainties regarding the deployment of the plans .

As per the report, as of 2022, there was a rise of 12% making the operating solar capacity in the SEA region nearly 32 GW.

Despite the dip in the market over the last two years, positive growths are observed with favourable government policies. For a more resilient and sustainable energy system, due to the climate crisis, the COVID-19 pandemic, supply chain bottlenecks, and trade tensions,many governments have announced stimulus packages and green recovery plans that prioritise renewable energy investment, including solar energy.

Solar Capacity Additions

Utility-scale, rooftop, and floating solar utility-scale solar energy have contributed to the solar capacity growth in the SEA region. Developments of large scale solar farms can be seen in countries such as Vietnam, Indonesia, and Malaysia, which is supported by government incentives and public-private partnerships. These are usually supported through auctions involving a competitive bidding process whereby winning projects are offered long-term PPA contracts. Vietnam’s Dau Tieng Solar Power Plant, with a capacity of 420 MW, is the largest solar power facility in Southeast Asia.

Net-metering

Countries such as Malaysia, Indonesia, Thailand, and Singapore have net-metering schemes in place and other incentives to promote rooftop solar installations in the residential, commercial, and industrial sectors. SEA countries have begun to integrate solar power into their energy policies and long-term energy plans. In the Philippines, the net-metering programme has successfully facilitated the adoption of rooftop solar systems, with over 64.2 MW of installed capacity. Vietnam’s ‘FiT 2’ feed-in tariff regime in the year 2020 also added more than 7 GW of rooftop capacity in the country. The fiscal and financial incentives, typically targeting the C&I sector have also supported the sector.

Floating Solar

Floating solar installation is also one of the promising and innovative solutions in the SEA region, particularly in countries having limited land availability for large-scale solar projects. Countries like Thailand and Singapore are already witnessing floating PV installations come online. In the Philippines, over 2 GW of installed capacity is set to be developed in Laguna Lake, Southeast Asia’s third largest lake, while in Indonesia a 2.2 GW floating solar project located in Batam is at the planning phase.

ESS Potential

Additionally, the integration of energy storage systems, such as battery energy storage, is gaining significance in the SEA solar energy landscape. Notably, many utility-scale solar projects in the region are incorporating energy storage solutions to optimise their solar energy output. While the regional PV supply chain landscape in the SEA region has witnessed the rise of domestic PV manufacturing capabilities to meet the growing demand for solar ,grid infrastructure limitations, financing availability, land constraints, skilled labour shortages, and policy and regulatory barriers – will be critical to ensuring the continued growth and success of the solar energy sector in the SEA region. To achieve the bold decarbonisation goals, substantial financial is needed by SEA nations to accomplish its planned renewable energy expansion by 2030.

What the Future Looks Like

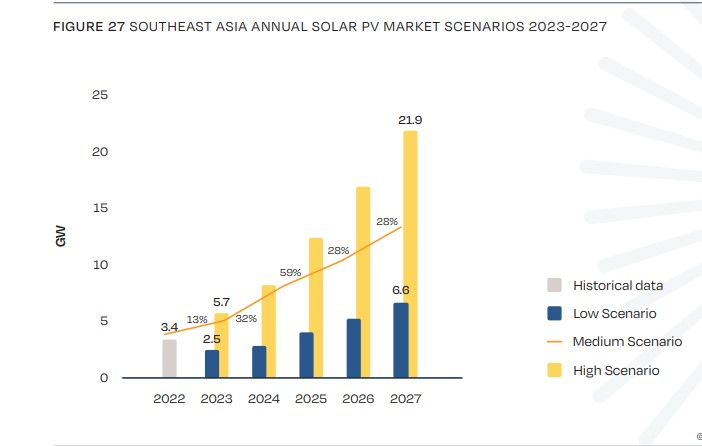

In next three years 2023-2027, the report says, this year, with the regulatory changes in the Vietnamese solar market, new capacity additions in the SEA region are expected to show upward trend. However, in the year 2024, higher growth is expected across the region. With a 32% growth, annual installations are forecasted to reach 5.1 GW. In the following years, the result of solar programmes becomes more apparent, bringing the regional market to 8.1 GW in 2025 (+59%), 10.4 GW in 2026 (+28%), and 13.3 GW in 2027 under a Medium Scenario. But key challenges can slow down the growth and installation volumes in 2027 could remain as low as 6.6 GW; however, the market would grow up to 21.9 GW under a high scenario.

Largest SEA Markets

Last few years have seen Southeast Asia growing exponentially in the installation of PV capacity. This is driven by its largest markets Vietnam, Thailand, Malaysia, Philippines, and Indonesia. Together, these countries host 95% of the region’s operating PV capacity. With most of them surpassing 1 GW of installed PV capacity, whereas other markets in the region like Cambodia, Laos, Myanmar and Singapore are expected to reach that level by no later than 2027, said the report.

Vietnam has experienced rapid growth in solar energy adoption in recent years. By 2023, the country is one of the leading players in the Southeast Asian solar energy market. Vietnam’s installed solar PV capacity has grown dramatically in the last five years, reaching approximately 19 GW by 2022. The recent PDP8 focuses deployment targets until 2030 and a long-term vision of the country’s power system to 2050.

Thailand has emerged as one of the leading countries in Southeast Asia for solar energy development. The government aims to add 100 MW of capacity per year from 2019 to 2027 through this initiative. In Solar has a total allocated capacity of 2.6 GW between 2024 and 2030. The government is currently working on its new National Energy Plan (NEP), a progressive strategy outlining the country’s energy system trajectory until the 2040s. Thailand aspires to achieve a 50% renewable energy share in electricity generation by 2036.

Malaysia’s solar energy landscape in 2023 focuses on rapid growth in renewable energy sources with supportive government policies, and significant investments from both international and domestic sources. In terms of efficiency and intensity, the country aims to achieve 52 TWh of electricity savings between 2016 and 2025, The Malaysian Government launched in 2022 its National Energy Policy 2022-2040, with the objective of enhancing macroeconomic resilience and energy security, achieving social equitability and affordability, and ensuring environmental sustainability.

According to the government plans, another 1.2 GW of capacity is needed to achieve the energy mix of 31% RE by 2025, out of which solar covers 1.1 GW. However, according to the report,the market will grow to a total of 6.4 GW in 2025.

The Philippines aims to reduce the energy generated from oil products, and electricity consumption, by 2040 by 5%, compared to a business-as-usual scenario.The Philippines also aims to reach a 10% penetration rate for electric vehicles in road transportation. In renewables,the Philippines is committed to increasing the renewable energy share in its power generation mix to 35% by 2030 and 50% by 2040.The Philippine Energy Plan 2020-2040 supports the country’s long-term vision (Ambisyon Natin 2040), targeting a clean energy future with ambitious renewable energy goals.However, the government decided to increase the annual increase from 1% to 2.52% starting in 2023. Large solar capacity volumes are expected to come online in the coming years through the GEA auction scheme started in June 2022, when GEA-1 awarded 1.5 GW of solar projects.

The next auction rounds GEA-2, whereby 7.6 GW of solar capacity is planned to be auctioned in June 2023 with project completion expected between 2024 and 2026. With an ambitious solar target of 18.6 GW by 2030 and massive auction volumes currently in the pipeline, Philippines’s solar PV capacity is expected to raise its growth trajectory in the next years. It is expected that the country will become the regional market leader by no later than 2025.

Indonesia seeks to increase the renewable energy share to 23% of primary energy supply by 2025, and 31% by 2050, and accomplish a 19.6% share of renewable energy electricity production by 2030. As per the SolarPower Europe High Scenario, the annual GW level could be already reached next year. However, as per IRENA’s Renewable Energy Outlook for ASEAN, Indonesia boasts a large potential for solar energy generation in the region, amounting to 2,898 GW.